What is lifetime pet insurance

Allie Simpson

23 November 2022 | 6 minutes read

Ready to feel the wind in your fur and be confident that you understand the world of pet insurance? We’re here to break down the ins and outs of lifetime pet insurance, including what it is and how it works.

- What is lifetime pet insurance?

- How does lifetime pet insurance work?

- Does lifetime pet insurance cover pre-existing conditions?

- How much does lifetime pet insurance cost?

> Does the cost of lifetime pet insurance go up every year? - What’s the difference between maximum benefit, time-limited, and lifetime pet insurance?

- Is lifetime pet insurance worth it?

What is lifetime pet insurance?

In a nutshell, ‘lifetime’ is a term used to describe how vet fees work for a type of pet insurance policy.

Should your pet develop an illness or condition, you can keep claiming as long as you renew each year. That’s why having a lifetime policy gives you the reassurance that your pet could be covered for life.

We believe that cats and dogs deserve the best and you deserve peace of mind. It’s why we only offer lifetime pet insurance, as it’s the most comprehensive type of cover out there.

It’s important to know that a lifetime policy doesn’t mean the price will stay the same over the life of your pet. The cost of their cover can still change each year and tends to go up as your pet gets older.

And not all lifetime policies are the same. Some providers use the term ‘annual limit’ and can offer policies with two types of limits:

- An overall yearly limit

- A yearly condition limit that pays up to a certain amount for each condition each policy year that you renew

To keep things easy, Petsure policies have just one overall limit that resets annually. You can claim for as many conditions as needed up to your chosen vet fee limit.

How does lifetime pet insurance work?

Understanding how lifetime pet insurance works doesn’t need to drive you barking mad.

To make things easier, let’s break down the process further.

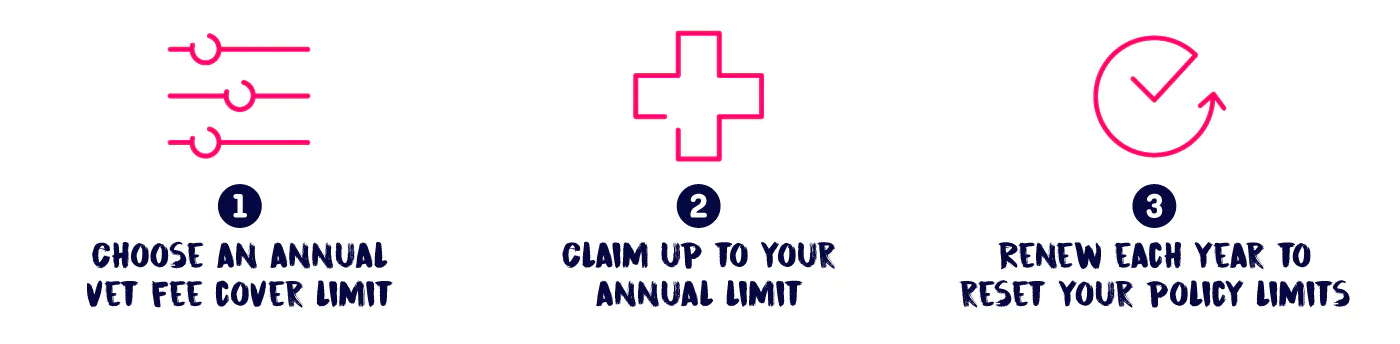

- Choose an annual vet fee cover limit that suits you and your pet’s needs. If optional, decide if you’d like to pay towards the cost of a claim by adding an excess or bill share.

- If your pet gets injured or falls ill and you need to claim, the cost will be taken from your annual limit. Claim as many times as needed for as many conditions up to your chosen annual limit each policy year.

- When you renew your policy, your chosen annual vet fee limit will renew back up to the full amount.

A few other need-to-knows about how lifetime pet insurance works

Find out whether there’s an excess for every condition you claim for each year, or whether you only need to pay the excess once in a policy year.

> Check whether you’ll need to pay anything towards the cost of a claim through an excess or co-payment. Some providers make these compulsory, but not with a Petsure lifetime policy.

> See if the provider will cover pre-existing conditions – but more on that later.

Does lifetime pet insurance cover pre-existing conditions?

Petsure considers all pet pre-existing conditions. When getting a quote, you’ll be asked about your pet’s health to see if we can cover them.

Sadly, not all lifetime pet insurance policies cover pre-existing conditions. This is dependent on the provider.

If an insurer does offer pre-existing conditions cover, remember to read their policy wording. Insurers may have their own definition of what is considered a pre-existing condition. This includes what conditions they’ll cover, whether there are any extra excesses to pay or any other limits to your cover.

How much does lifetime pet insurance cost?

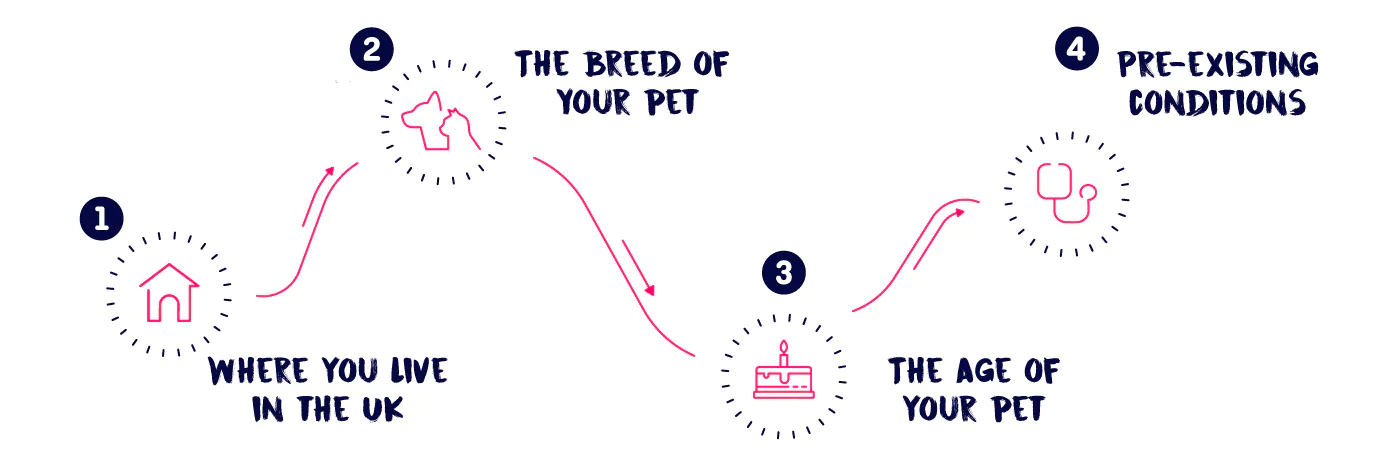

The exact cost of lifetime pet insurance depends on your dog or cat. Different things may affect how much you pay, including:

- Where you live in the UK

- The breed of your pet

- The age of your pet

- Pre-existing conditions (if they can be covered)

You could also end up paying more for lifetime pet cover than other types of pet insurance options. This is because it’s the most comprehensive type of cover. You also have the choice between paying off the policy in one go or spreading out the cost monthly, which may help to make it more manageable.

You might think it’s easiest to jump to the cheapest option when it comes to choosing pet insurance. Before doing this, you may want to take a step back and consider what is right for your pet and their specific needs, and if your chosen policy meets these needs.

> Does the cost of lifetime pet insurance go up every year?

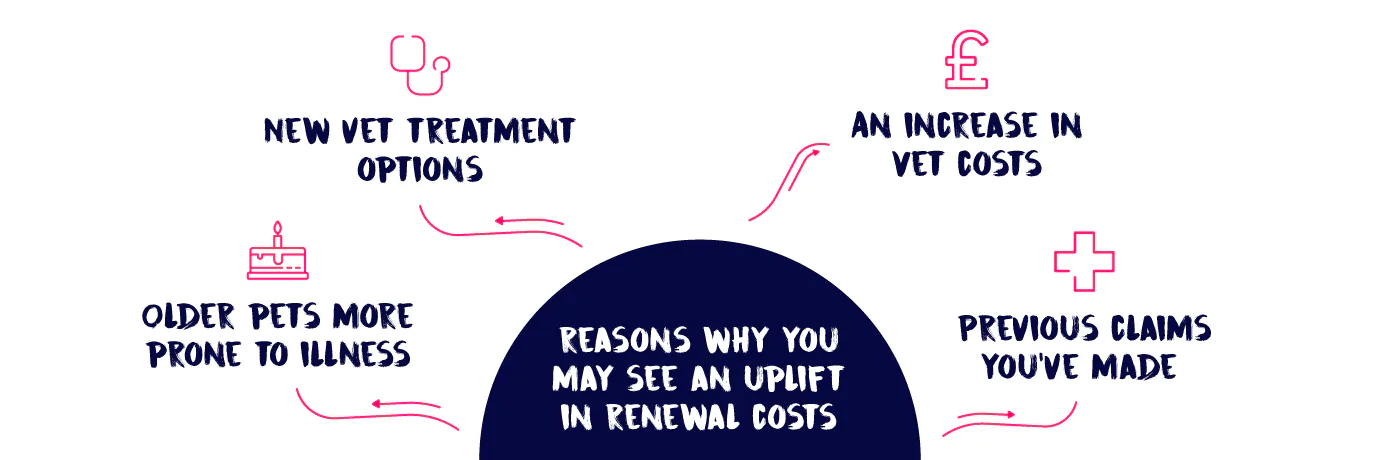

The monthly cost of lifetime pet insurance could go up each year. This may get your hackles up, but there’s several reasons why you may see an uplift in renewal costs:

- As your pet ages, there’s a higher chance of illness

- The introduction of new and sophisticated treatments

- An increase in veterinary costs in your area

- Previous claims made on your pet’s insurance policy

Remember, you’re paying to cover the risk of something happening to your pet in the next year. With time, the risk changes, and so the monthly premium will also change to reflect this.

What’s the difference between lifetime and other types of pet insurance?

Lifetime pet insurance has a vet fee limit that resets each year you renew the policy.

Then there’s products like time-limited and maximum benefit pet insurance. These cheaper policies may have a time limit on how long you can claim for new conditions. Or only cover new conditions up to a certain vet fee limit. So it can get confusing as to when and by how much you can claim.

Want a detailed breakdown of the difference between maximum benefit, time-limited, and lifetime pet insurance? Have a read of our blog on how to choose the best pet insurance for your pet.

Is lifetime pet insurance worth it?

Only you can decide whether lifetime pet insurance is worth it for your pet. For many owners, not having to compromise on the health and wellbeing of their cat or dog is priceless.

And having pet insurance with a vet fee limit that refreshes each year could give you peace of mind. Your pet can continue to be covered throughout their lifetime for accidents, short-term illnesses, and ongoing conditions.

While there’s lots of positive reasons to pick lifetime pet insurance, think about taking the time to research other types of pet insurance available. You’ll then hopefully have all the info you need to decide what’s best for your pet.